Discover what ION can do for you

About Aspect

Aspect is for traders, refiners, producers, and marketers of crude oil, refined petroleum products, petrochemicals, and metals, as well as carbon traders. The front-to-back, multi-tenant SaaS solution covers physical and financial trading workflows with integrated market data, sophisticated analytics, and real-time reporting. With rapid deployment times, Aspect provides a quick return on investment so you can capitalize on new opportunities faster.

Why Aspect

Companies around the world rely on Aspect for an easy-to-use, web-based commodity trading solution to manage their business. As the leading enterprise commodity management, multi-tenant SaaS solution, Aspect’s unparalleled performance gives you the agility to succeed in today’s volatile markets. With automatic upgrades and integrated data feeds, you can be confident that your solution adapts to the latest market trends.

Multi-tenant SaaS

Fast deployment and immediate ROI

Accessible anywhere, on any device

Customizable to your needs

Always on the latest version

Connected to your markets

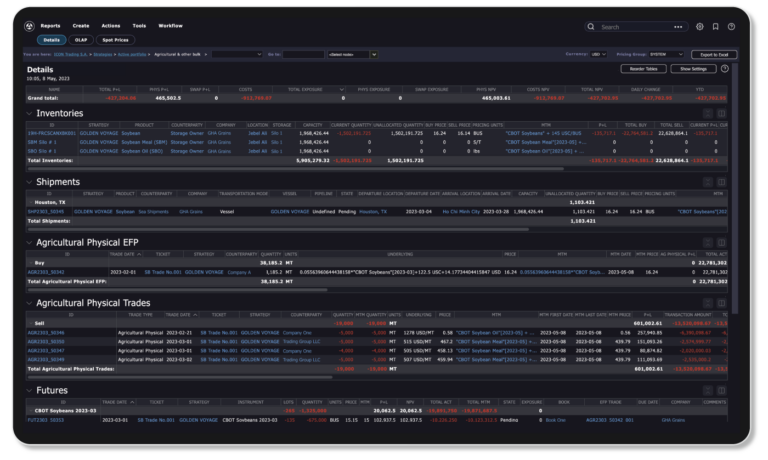

Key features

SaaS offering

No maintenance overhead.

Scale from single users to thousands.

Lowest cost of ownership.

Fast speeds

Quick deployment with immediate ROI.

Optimized for rapid performance and operational flexibility.

Real-time calculations and reporting.

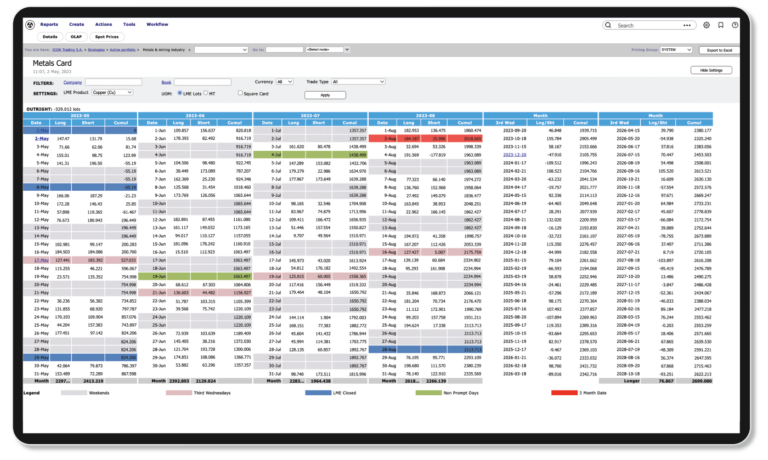

Modern user experience

Simple-to-use, web-based UX.

Access anywhere, on any device.

Secured in the ION Cloud.

Data and market connectivity

Standard exchange connectivity with seamless continuity of service.

Integrated with DSC for real-time market prices.

Pre-packaged with industry-standard reference data.

Enhance your solution with optional value-added modules

Hosted exclusively on the ION Cloud, Aspect’s front-to-back solution provides complete coverage of the entire trade capture and risk management lifecycle. Aspect is enhanced with market data from leading exchanges and news sources, empowering your decision making.

Decision Support Center (DSC)

Support traders globally by providing access to a market data and news aggregation platform, available on all devices. Mitigate price risk in uncertain and volatile markets with full pricing automation.

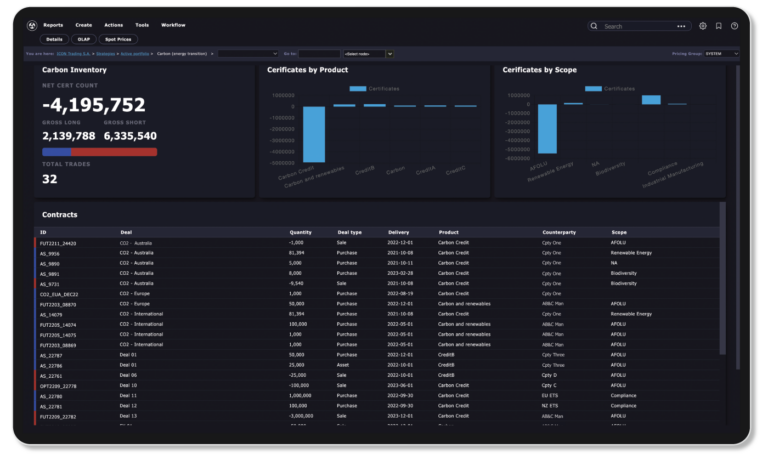

Carbon Zero

Manage your energy transition with a simple, fast trading and inventory solution that covers the full carbon and renewable certificate lifecycle.

ION Cloud

Lower your total cost of ownership and modernize your technology to optimize your operations and empower your business. Secure your data with ION’s multi-layered, trusted security stack.

Frequently Asked Questions

We run our commodity business on spreadsheets. Why do we need a CTRM?

Spreadsheets don’t easily support collaboration between various departments. It can be difficult to ensure that every member of the company is working with the most up-to-date, accurate data. Without a central repository for all trades and related information, companies can have hundreds or even thousands of spreadsheets circulating at any given time. Because individuals like to see data differently, multiple versions of spreadsheets are often used by different traders, managers, and executives.

With Aspect, your organization benefits from a trusted, company-wide system of record, ensuring your entire business can access a single source of truth on demand. With Aspect’s scripting language, you can customize screens and configurable workflows so they fit your business processes.

What differentiates Aspect from its competitors?

Unlike other higher-priced competitors, Aspect provides a standard, true SaaS offering with a simple scripting language to support customized reporting and rich workflows.

Aspect’s in-memory database means all trades and transactions are stored in memory for your immediate retrieval. Aspect’s web-based platform provides hundreds of standard reports.

What are the advantages of SaaS technology?

- Fast deployment

- Lowered cost of ownership

- Automatic, seamless upgrades

- Improved user adoption

- Reduced support needs

How can Aspect be integrated into my enterprise software landscape?

Aspect is evolving to enable the commodity ecosystem with seamless integration and data-rich solutions. This unlocks the complete set of solutions from ION and the broader marketplace, including ERPs.